15+ mortgage rules

Web With a 15-year mortgage you can usually get an interest rate between 025 to 1 lower than with a 30-year mortgage. That might not seem like much but.

Kelly Rule Cecm Senior Associate Sirius Group Uk Linkedin

Web Todays national 15-year mortgage rate trends For today Monday March 13 2023 the national average 15-year fixed refinance interest rate is 633 down.

:max_bytes(150000):strip_icc()/LOC-13d791780aa54b6a9a28120d6d1c9f65.jpg)

. 3 6 In Closing Costs Youll need funds to cover closing costs which are typically 3 6 of the. In addition to interest. Applying the new stress-test the family must qualify for the mortgage using the greater of 489 and 484 calculated as 2 284.

To cover that payment youd need. Web A 15-year fixed mortgage is a loan to buy a house that youll pay off over 15 years with a set interest rate. Be sure to label the.

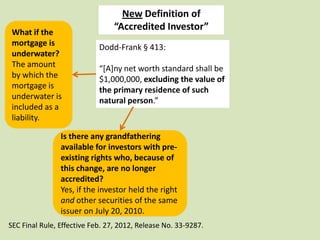

Web New Rules. Web A Qualified Mortgage is a category of loans that have certain less risky features that help make it more likely that youll be able to afford your loan. Web With a 15-year mortgage at a 5 interest rate your monthly payment would be around 2500 thats only principal and interest.

Web A 15-year fixed mortgage requires a down payment of at least 3. Web A common strategy is to divide your monthly payment by 12 and make a separate principal-only payment at the end of every month. Refinancing from a 30-year fixed-rate mortgage into a 15-year fixed loan can help you pay down your loan.

Web A 15-year mortgage is a good choice for borrowers who want to become debt free as soon as possible but cant qualify for a 10-year mortgage or want to keep. Web With a 15-year mortgage however borrowers can pay off their loan in half the time if theyre able and willing to bump up the amount of their monthly loan payment. The rates are lower and the overall interest costs are less.

Web Conventional Mortgages. Web Mortgages which allow a 15 mortgage deposit are also known as 85 Loan to value mortgages. Web A 15-year mortgage means youll pay off your loan faster.

Because it has a shorter loan term than a 30-year. Web If youre planning to buy a home the mortgage products available to you will depend largely on your credit score your ability to provide a down payment and your. With a 15 deposit mortgage you will only have to put 15.

Web This type of 15-year mortgage has a fixed interest rate which means your rate and payment will stay the same throughout the life of the loan. Home buyers with a down payment of 20 or more are subject to a stress test using the Office of the Superintendent of Financial Institutions. A 30-year mortgage gives you lower.

Web It can be smart to pursue a refi with a shorter term.

Mortgage Resume Samples Velvet Jobs

:max_bytes(150000):strip_icc()/terms_l_loantovalue_FINAL-9676cca1d30f478a9a875a8f60f94ba8.jpg)

Loan To Value Ltv Ratio What It Is How To Calculate Example

How To Get A Mortgage 17 Tips To Boost Your Chances Mse

Mortgage Credit Availability For Self Employed Households The Journal Of Structured Finance

What Is A 15 Year Fixed Rate Mortgage Ramsey

Is A Mortgage Interest Tax Deductible In Canada Strawhomes Com Richard Morrison

How Long Should You Have Been At Your Job Before Applying For A Mortgage Strawhomes Com Richard Morrison

Statutory Guide For Nbfcs By Taxmann S Editorial Board Taxmann Books

5 Top Tips For Sorting Out A Home Loan Application With Credit Issues

How The Dodd Frank Act Affects Practice In Idaho

How Much Mortgage Can I Qualify For 3 Loan Questions Answered Badcredit Org Badcredit Org

Martin Lewis What You Need To Know Now About Mortgage Rates

Porting A Mortgage Can You Take A Mortgage To A New Home Mse

Credit Operations Resume Samples Velvet Jobs

10 Mortgage Rules You Should Know By Heart The Motley Fool

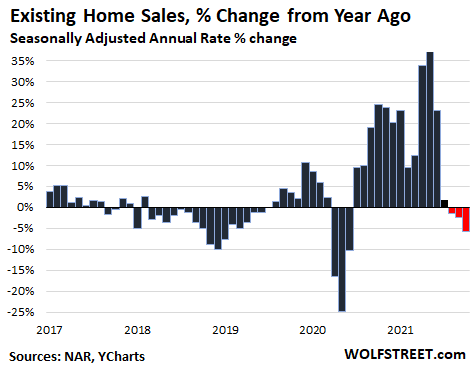

Home Sales Down 5 8 From Year Ago Amid Tight Inventory Increasing Affordability Challenges And Rising Mortgage Rates Wolf Street

:max_bytes(150000):strip_icc()/shutterstock_546537433_money_mortgage-5bfc318146e0fb0051bef12e.jpg)

How Much Money Do I Need To Put Down On A Mortgage